After ten years of teaching, numerous PD courses, books and online documents, I have finally hammered down my math program. When introducing a new math concept, students can feel overwhelmed or confused. I like to break down each math expectation with a weekly focus on each one (giving extra time if needed). Ten years later, this is the structure that I have enjoyed the most and find my students enjoy the most:

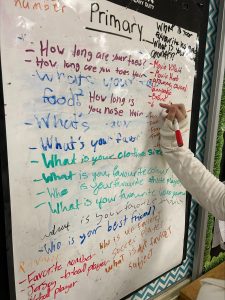

Monday- introduce concept with key terms, videos and 1-2 examples on the board

Tuesday- practice questions on whiteboards where students ask for help if needed

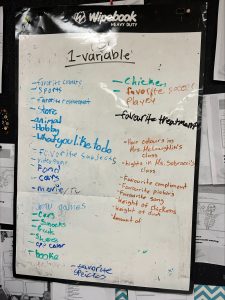

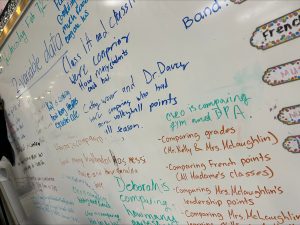

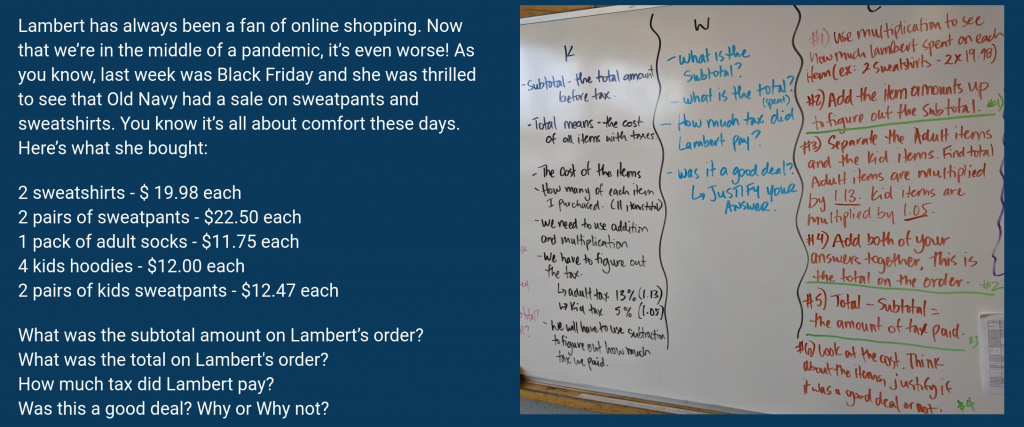

Wednesday- “Thinking Classroom” collaborative task where students work on 1-2 problems with a group of 3-4 students

Thursday- math task with 3-4 questions, one bonus with an extension into further concepts

Friday- math games to further the concept on gimkit, kahoot or knowledgehook

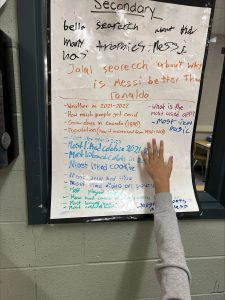

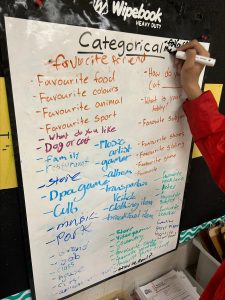

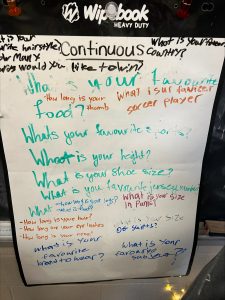

Their math mark is based on a combination of observations, conversations and a weekly product. My favourite day by far is Wednesdays where I randomly assign groups with numbered popsicle sticks. Students meet their group mates at their wipebook and get started on their question. I will post the most recent questions we solved and some of their solutions. Before each lesson, I ask students “What makes a great collaborator?” Student answers vary but often include:

- A great listener

- Someone who includes students who are not involved

- Someone who listens without judgement

- Someone who does the work

Then, I walk around and look for evidence of the student-generated collaboration criteria. I also ask them questions about their math responses, never telling them they are on the wrong track but asking them about their process. After they have found some solutions, I pause the groups and ask them to walk around the room to view the other solutions. Sometimes I ask them to point to the wipebook that had their favourite process or the most organized process. We never take up the answers or I never correct their boards. Students often correct their own once the view the other boards. At the end of the class, I call students out into the hall and have them comment on the student who they thought collaborated the best in their group.

That is my version of the “Thinking Classroom” in math with a focus on collaboration.

Question and Student Responses:

This question was created using ideas from openmiddle.com.